Updated May 24, 2020

What the ACMG is doing

-

The ACMG Team is keeping track of various initiatives and benefit programs as they are rolled out by government agencies and will keep this page updated. If you are aware of a program not listed here, see a mistake or dead link, let us know: [email protected]

Updates On Assistance Programs

Find financial help during COVID-19

The federal government launched an online tool to help Canadians navigate the various financial benefits available during the pandemic.

https://covid-benefits.alpha.canada.ca/en/start

COVID-19 Resource Centre

To support Western Canada's business community navigate the legal impacts and implement business continuity plans as a result of COVID-19

https://www.mltaikins.com/service/covid-19-resource-centre/

The federal government is:

- widening the eligibility criteria of the Canada Emergency Business Account (CEBA) - previously announced government-guaranteed loans up to $40,000 - to capture small- and medium-sized businesses that paid between $20,000-$1.5 million in total payroll in 2019. More information is available here: https://ceba-cuec.ca/

- planning to introduce the Canada Emergency Commercial Rent Assistance (CECRA) for small businesses

- the program, contingent on partnerships with provincial and territorial governments, will provide loans to commercial property owners who will lower or forgo rent for April (retroactive), May and June. More details are expected in the days ahead.

Provincially, the BC Business COIVD-19 Support Service, which will advise businesses on available resources, was launched today:

- the service will be operated by Small Business BC (SBBC)

- inquiries can be made via email, phone, and live chat on the website. More information about the service is available here: https://news.gov.bc.ca/releases/2020JEDC0008-000700

Carole James, BC's Minister of Finance, offered tax relief to businesses, announcing:

- a 25 percent cut to most commercial property bills, due to a second reduction in school property tax payments; and,

- the late payment deadline for property taxes has been extended to October 1.

The Federal and several Provincial governments in Canada have announced programs to support businesses and individuals to help with financial challenges due to the COVID-19 pandemic. Please continue to check their websites as this is a continuously evolving situation.

Update: The federal government is widening the eligibility for the Canadian Emergency Response Benefit (CERB) to include:

- seasonal workers who cannot find work due to the COVID-19 pandemic

- people earning less than $1000 a month due to reduced work hours

- Canadians who have exhausted their EI benefits since January 1

CERB, designed to help Canadians cope with the economic fallout of COVID-19, pays recipients $500 a week for up to sixteen weeks. More information about criteria and the application process is available here: https://www.canada.ca/en/services/benefits/ei/cerb-application.html.

-

Financial help for Canadians affected by COVID-19

Here is a great CBC site that helps you find the the benifits most relevent to you. It is a hub of federal government, provinces and territories programs.

https://newsinteractives.cbc.ca/coronavirusbenefits/

- This is a document put compiled by Jennifer Robson, Associate Professor of Political Management, Carleton University using public information It has a great deal of information about benefit programs and resources. It was published March 27th, so some info might be dated but much will likely remain useful.

https://pecchamber.com/wp-content/uploads/2020/03/Benefit_information_3_27.pdf

Federal Programs

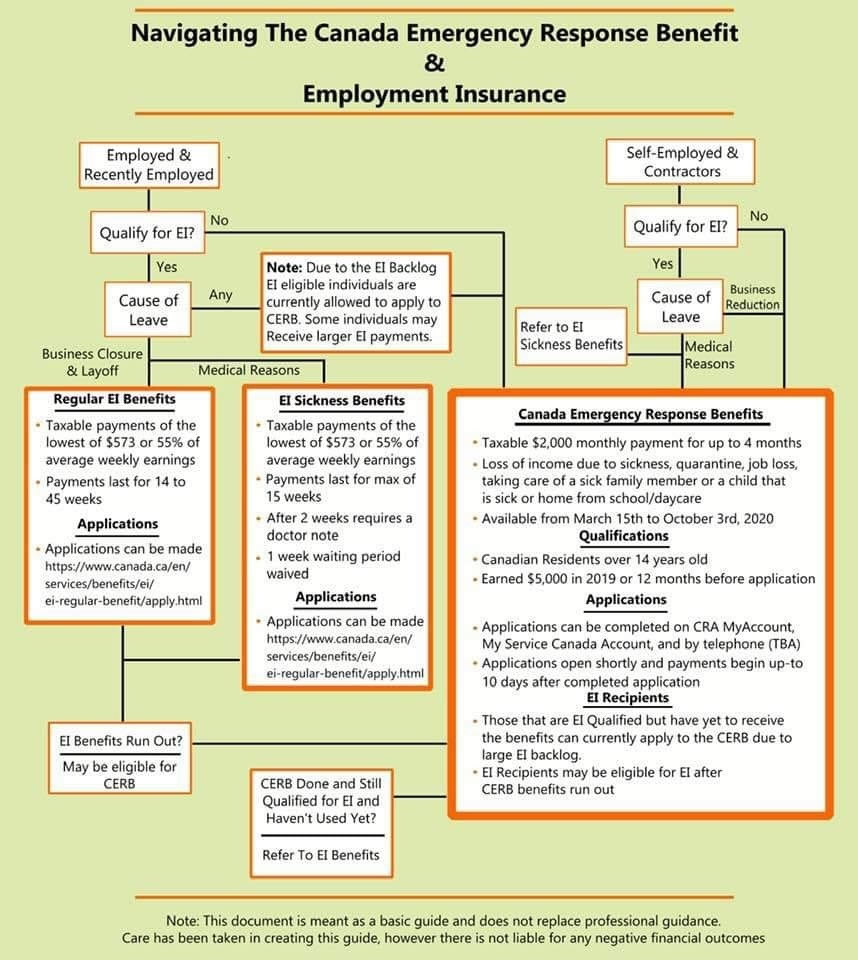

FEDERAL GOVERNMENT - EMPLOYMENT INSURANCE (EI)

- If you were working for an employer and lost your job and are eligible for Employment Insurance (EI), you can apply at:

https://srv270.hrdc-drhc.gc.ca/AW/introduction?GoCTemplateCulture=en-CA

FEDERAL GOVERNMENT - Overview

- Overview of the Canadian Government COVID-19 Economic Response Plan with links to specifics:

https://www.canada.ca/en/department-finance/economic-response-plan.html

FEDERAL GOVERNMENT-CERB

A taxable benefit providing $2,000 a month, for up to four months, for workers who lose their income due to the COVID-19 pandemic.

Who can apply

To be eligible, you must meet the following requirements:

- You reside in Canada

- You are 15 years old or more when you apply

- For your first CERB application:

- You have stopped or will stop working due to reasons related to COVID-19

- For at least 14 days in a row for the period you are applying for, you will not receive:

- employment income

- self-employment income

- provincial or federal benefits related to maternity or paternity leave

- For your subsequent CERB applications:

- You continue to not work due to reasons related to COVID-19

- For the 4 week period you are applying for, you will not receive:

- employment income;

- self-employment income; or

- provincial or federal benefits related to maternity or paternity leave.

- You have not quit your job voluntarily

- You did not apply for, nor receive, CERB or EI benefits from Service Canada for the same eligibility period

- You earned a minimum of $5,000 income in the last 12 months or in 2019 from one or more of the following sources:

- employment income

- self-employment income

- provincial or federal benefits related to maternity or paternity leave

Eligibility periods

Eligibility periods are fixed in 4-week periods.

If your situation continues, you can re-apply for CERB for multiple 4-week periods, to a maximum of 16 weeks (4 periods).

How to Apply

There are two ways to apply:

- Online with CRA My Account

- Over the phone with an automated phone service

Before you call

To verify your identity, you'll need - your social insurance number (SIN)

- postal code

Follow the instructions below before you call 1-800-959-2019 or 1-800-959-2041

FEDERAL GOVERNMENT - Support for individuals and families

- This page has links to several programs and benefits

https://www.canada.ca/en/department-finance/economic-response-plan/covid19-individuals.html

FEDERAL GOVERNMENT - Overview, Support for Businesses

- This page has links to several programs and benefits

https://www.canada.ca/en/department-finance/economic-response-plan/covid19-businesses.html

FEDERAL GOVERNMENT - Support for Businesses, Temporary Wage Subsidy for Employers

- A three-month measure that will allow eligible employers to reduce the amount of payroll deductions required to be remitted to the Canada Revenue Agency (CRA). The subsidy is equal to 10% of the remuneration you pay between March 18, 2020, and June 20, 2020, up to $1,375 per employee and to a maximum of $25,000 total per employer.

Who is eligible?

- Non-profit organizations, registered charity, or a Canadian-controlled private corporation (CCPC)

- Have an existing business number and payroll program account with the CRA on March 18, 2020; and

- Pay salary, wages, bonuses, or other remuneration to an employee.

https://www.canada.ca/en/revenue-agency/campaigns/covid-19-update/frequently-asked-questions-wage-subsidy-small-businesses.html

Provicial Programs

PROVINCE OF ALBERTA - Emergency Isolation Support

- One-time emergency payment of $1,146 if they are required to self-isolate or are the sole caregiver of someone in self-isolation and they have no other source of income.

- Intended as a "bridge" until the CERB portal [see above] is open around April 6.

- Apply here: https://www.alberta.ca/emergency-isolation-support.aspx

PROVINCE OF ALBERTA - payment deferrals

Utility and Student Loans Repayment Deferral

- Residential customers can defer electricity and natural gas bill payments for the next 90 days to ensure no one will be cut off, regardless of the service provider.

- This program is available to Albertans who are experiencing financial hardship as a direct result of COVID-19. For example, those who have lost their employment or had to leave work to take care of an ill family member.

- Call your utility provider directly to arrange for a 90-day deferral on all payments.

- Implementing a six-month, interest free, moratorium on Alberta student loan payments for all Albertans in the process of repaying these loans.

https://www.alberta.ca/covid-19-supports-for-albertans.aspx?

PROVINCE OF BRITISH COLUMBIA - COVID-19 assistance programs

- Overview of BC assistance available:

https://www2.gov.bc.ca/gov/content/employment-business/covid-19-financial-supports

- For information on B.C.'s COVID Action Plan and other government resources and updates, visit:

http://www.gov.bc.ca/covid19 - COVID-19 support service launched for B.C. businesses

A new B.C. Business COVID-19 Support Service will serve as a single point of contact for businesses throughout the province looking for information on resources available during the COVID-19 pandemic.

READ MORE

- New COVID-19 supports for businesses, local governments

The Province is providing enhanced relief for businesses by reducing most commercial property tax bills by an average of 25%, along with new measures to support local governments facing temporary revenue shortfalls as a result of COVID-19.

READ MORE

-

Applications for the BC Emergency Benefit for Workers (BCEBW) begins May 1:

- The one-time, tax-free $1000 payment offers financial support to residents who cannot work due to the COIVD-19 pandemic

- Payments will be sent within days of applying

- Information on eligibility and how to apply:

- For seniors needing help with non-medical essentials, from shopping for and delivering groceries; prescriptions; to a daily check-in call.

- Also seeking (non-senior) volunteers for this work

- Visit http://www.bc211.ca/safe-seniors-strong-communities/ or dial 211 in BC.

PROVINCE OF ONTARIO (southern)

- For tourism operators or small- or medium- sized businesses or organizations that received FedDev Ontario funding and COVID-19 is affecting your operations, contact your project officer as you may be eligible for flexible arrangements.

- If you are a tourism operator or small- or medium- sized business or organization impacted by the sudden shifts in the economy, FedDev Ontario can help you navigate the support available.

https://www.feddevontario.gc.ca/eic/site/723.nsf/eng/00018.html - For more information on additional government support available to your business and workers, please contact Service Canada at 1-800-OCanada (1-800-622-6232).

https://www.feddevontario.gc.ca/eic/site/723.nsf/eng/h_02567.html?OpenDocument

PROVINCE OF QUEBEC

- Overview of assistance: https://www.quebec.ca/en/family-and-support-for-individuals/financial-assistance/

- Financial Assistance - Temporary Aid for Workers Program https://www.quebec.ca/en/family-and-support-for-individuals/financial-assistance/temporary-aid-for-workers-program/

Navigating Canada's Benefit Programs

Featured Partner

Thank you to our partners for their excellent support and commitment to professional guiding in Canada.